All Categories

Featured

Table of Contents

For many people, the most significant issue with the limitless banking idea is that preliminary hit to very early liquidity created by the prices. This con of infinite financial can be decreased significantly with appropriate plan design, the initial years will constantly be the worst years with any kind of Whole Life policy.

That claimed, there are particular infinite financial life insurance coverage policies designed largely for high very early cash money worth (HECV) of over 90% in the initial year. However, the long-lasting performance will certainly frequently considerably lag the best-performing Infinite Banking life insurance plans. Having access to that extra four numbers in the very first couple of years might come with the expense of 6-figures down the road.

You really obtain some considerable long-term benefits that help you recover these early expenses and after that some. We discover that this impeded early liquidity trouble with limitless banking is more psychological than anything else once extensively discovered. If they definitely required every penny of the cash missing out on from their infinite banking life insurance plan in the first few years.

Tag: infinite financial concept In this episode, I talk about funds with Mary Jo Irmen who instructs the Infinite Financial Principle. With the increase of TikTok as an information-sharing platform, monetary suggestions and approaches have located a novel way of spreading. One such approach that has actually been making the rounds is the boundless financial principle, or IBC for brief, amassing recommendations from celebs like rap artist Waka Flocka Fire.

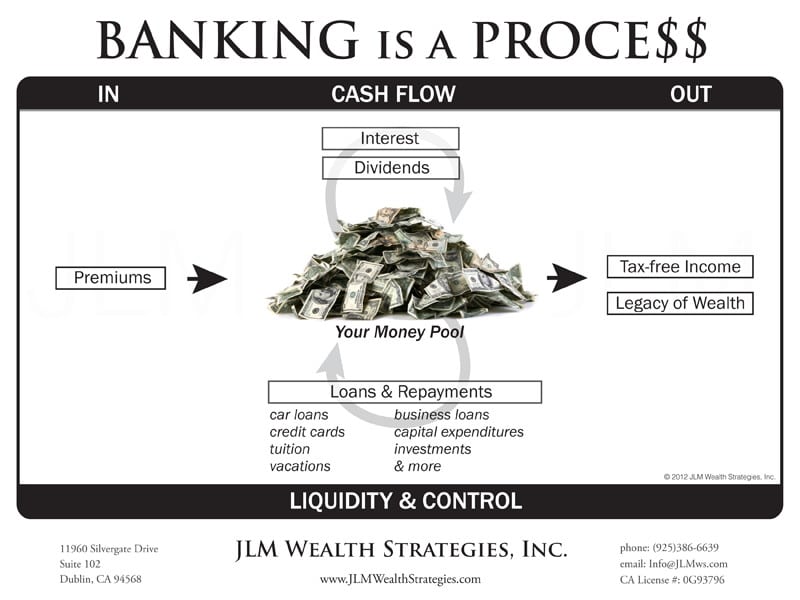

Within these policies, the cash value grows based on a rate set by the insurance provider. As soon as a considerable money worth accumulates, insurance policy holders can obtain a money value financing. These loans vary from standard ones, with life insurance policy functioning as collateral, implying one could shed their coverage if loaning excessively without sufficient cash worth to support the insurance policy prices.

And while the attraction of these plans is noticeable, there are inherent constraints and risks, requiring persistent cash money worth surveillance. The method's authenticity isn't black and white. For high-net-worth individuals or company owners, especially those making use of techniques like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and compound development could be appealing.

Infinite Banking Services Usa

The allure of boundless banking does not negate its challenges: Price: The foundational requirement, a long-term life insurance policy plan, is costlier than its term counterparts. Eligibility: Not every person gets entire life insurance policy because of rigorous underwriting processes that can leave out those with certain wellness or way of living problems. Intricacy and danger: The elaborate nature of IBC, coupled with its dangers, may hinder numerous, specifically when less complex and much less high-risk options are readily available.

Assigning around 10% of your regular monthly income to the plan is simply not viable for lots of people. Making use of life insurance policy as an investment and liquidity resource calls for self-control and surveillance of policy cash money worth. Consult a financial advisor to identify if infinite financial straightens with your concerns. Component of what you check out below is simply a reiteration of what has already been said over.

Before you obtain on your own into a scenario you're not prepared for, know the following initially: Although the principle is commonly marketed as such, you're not in fact taking a financing from yourself. If that held true, you would not need to repay it. Instead, you're borrowing from the insurance policy company and need to settle it with rate of interest.

Some social media sites blog posts advise making use of cash money value from whole life insurance policy to pay down credit rating card financial obligation. The concept is that when you repay the loan with interest, the quantity will certainly be returned to your financial investments. That's not exactly how it functions. When you repay the loan, a section of that rate of interest mosts likely to the insurance company.

For the first numerous years, you'll be paying off the compensation. This makes it exceptionally challenging for your policy to gather worth throughout this time. Whole life insurance expenses 5 to 15 times extra than term insurance. Most individuals just can not manage it. So, unless you can pay for to pay a couple of to numerous hundred dollars for the next decade or even more, IBC won't function for you.

Start Your Own Personal Bank

Not everyone ought to rely entirely on themselves for economic security. If you require life insurance coverage, right here are some useful ideas to consider: Think about term life insurance. These policies supply insurance coverage during years with substantial monetary commitments, like mortgages, pupil fundings, or when looking after children. See to it to search for the very best rate.

Copyright (c) 2023, Intercom, Inc. () with Booked Font Call "Montserrat". Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Scheduled Font Name "Montserrat".

How To Use Whole Life Insurance As A Bank

As a certified public accountant specializing in real estate investing, I've brushed shoulders with the "Infinite Banking Idea" (IBC) much more times than I can count. I've even talked to specialists on the subject. The primary draw, in addition to the apparent life insurance coverage advantages, was constantly the concept of developing cash worth within a long-term life insurance policy policy and loaning against it.

Certain, that makes feeling. Honestly, I always assumed that money would certainly be better spent directly on financial investments rather than channeling it with a life insurance plan Till I found how IBC could be integrated with an Irrevocable Life Insurance Trust Fund (ILIT) to produce generational riches. Allow's start with the fundamentals.

Infinite Banking Real Estate

When you borrow versus your plan's cash worth, there's no set settlement routine, offering you the liberty to take care of the finance on your terms. The cash worth proceeds to expand based on the policy's assurances and rewards. This arrangement allows you to gain access to liquidity without disrupting the long-lasting growth of your policy, gave that the finance and interest are taken care of wisely.

As grandchildren are born and grow up, the ILIT can purchase life insurance policy policies on their lives. Family members can take car loans from the ILIT, utilizing the cash worth of the policies to fund financial investments, begin organizations, or cover major expenditures.

A vital facet of handling this Household Financial institution is the usage of the HEMS standard, which stands for "Wellness, Education And Learning, Upkeep, or Support." This guideline is frequently included in count on contracts to route the trustee on exactly how they can disperse funds to recipients. By adhering to the HEMS criterion, the trust fund makes sure that circulations are created necessary requirements and long-lasting assistance, safeguarding the trust fund's possessions while still offering member of the family.

Raised Flexibility: Unlike rigid small business loan, you manage the payment terms when obtaining from your very own plan. This enables you to structure repayments in such a way that aligns with your service capital. benefits of infinite banking. Better Capital: By financing overhead via policy financings, you can possibly maximize money that would certainly or else be tied up in conventional car loan repayments or equipment leases

He has the very same equipment, yet has also constructed additional money value in his policy and obtained tax obligation benefits. Plus, he now has $50,000 available in his plan to use for future chances or expenses., it's important to view it as more than just life insurance policy.

Infinite Banking Concept Canada

It's regarding developing a versatile financing system that gives you control and supplies several advantages. When made use of purposefully, it can enhance other financial investments and service strategies. If you're intrigued by the potential of the Infinite Financial Concept for your business, right here are some actions to consider: Enlighten Yourself: Dive much deeper right into the principle via credible publications, seminars, or examinations with knowledgeable experts.

Latest Posts

'Be Your Own Bank' Mantra More Relevant Than Ever

Whole Life Insurance-be Your Own Bank : R/personalfinance

Private Family Banking Life Insurance